- Thomas Moran Weekly Recap

- Posts

- Real Estate Rundown | March 27

Real Estate Rundown | March 27

Unpacking This Week's Luxury Real Estate Trends, Economic Shifts, Biden Tax Credit and the Impact of Immigration Policies on NYC's Housing Affordability and Safety

Market Pulse

Last week in Manhattan, the luxury real estate market saw twenty-five properties, each priced at $4 million and above, go under contract. This marked a significant decrease from the previous week's high of forty contracts, posing the question of whether that surge was an outlier or part of a broader trend—only time will reveal the answer. Condominiums led the sales with fourteen contracts, while co-ops saw four, and seven townhouses. In fact, the number of townhouses sold matched the highest weekly total since last June, as reported by Olshan Realty. Despite the week-over-week decline, the fact that at least twenty-five luxury contracts have been signed for six consecutive weeks suggests a steady demand in this segment. The properties sold last week had a total asking price of $206.9 million, with an average price of $8.3 million and a median close to $7 million, after staying on the market for an average of 584 days and selling at a 12 percent discount. This gives us a glimpse into the current state of Manhattan's luxury market, which continues to show resilience.

Top Sale

109 Waverly Place

Last week's top sale in Manhattan was a magnificent townhouse at 109 Waverly Place. Initially listed in August 2022 for $24,950,000, its asking price was adjusted to $19,950,000, capturing the attention of a discerning New York buyer. This 25-foot-wide, four-story residence spans an impressive 8,300 square feet, boasting seven bedrooms and six bathrooms, along with two additional powder rooms, catering to both grandeur and convenience. The house is equipped with an elevator, seamlessly connecting each floor and enhancing the living experience. The basement is a haven for relaxation and entertainment, featuring a lap pool, gym, sauna, and wine cellar—each element thoughtfully designed for luxury living. The ground floor houses a spacious kitchen that opens onto a serene garden, offering a perfect blend of indoor and outdoor living. This exquisite property, purchased by the seller for $17,750,000 in March 2011, represents the pinnacle of architectural elegance and refined taste in one of Manhattan's most sought-after locations.

Tax Breaks vs. Housing Market Reality: Assessing the Effectiveness of Biden's Affordability Strategy

In an ambitious move to tackle the nation's affordable housing crisis, President Joe Biden has proposed a series of tax breaks aimed at first-time homebuyers and those selling their "starter homes." The cornerstone of this initiative is a "mortgage relief credit," offering $5,000 per year for two years to middle-class, first-time homebuyers. This measure is designed to act like a reduction in the mortgage interest rate for a median-priced home by 1.5 percentage points for two years. Additionally, a one-year credit of up to $10,000 is proposed for middle-class families transitioning from their "starter homes" to new residences. This proposal defines "starter homes" as properties priced below the median for the seller's county, aiming to stimulate the housing market and alleviate some of the affordability pressures.

While the intention behind these proposals is to ease the burden on potential homebuyers and stimulate housing turnover, experts have raised concerns about their potential effectiveness and the broader implications for the housing market. For instance, a report by the National Review critically assesses Biden's plan, arguing that it resembles a bad credit-card promotion, likely to exacerbate the very problems it seeks to solve. The report highlights that, amidst falling interest rates, government subsidies could inadvertently fuel demand, leading to even higher housing prices.

FreddieMac

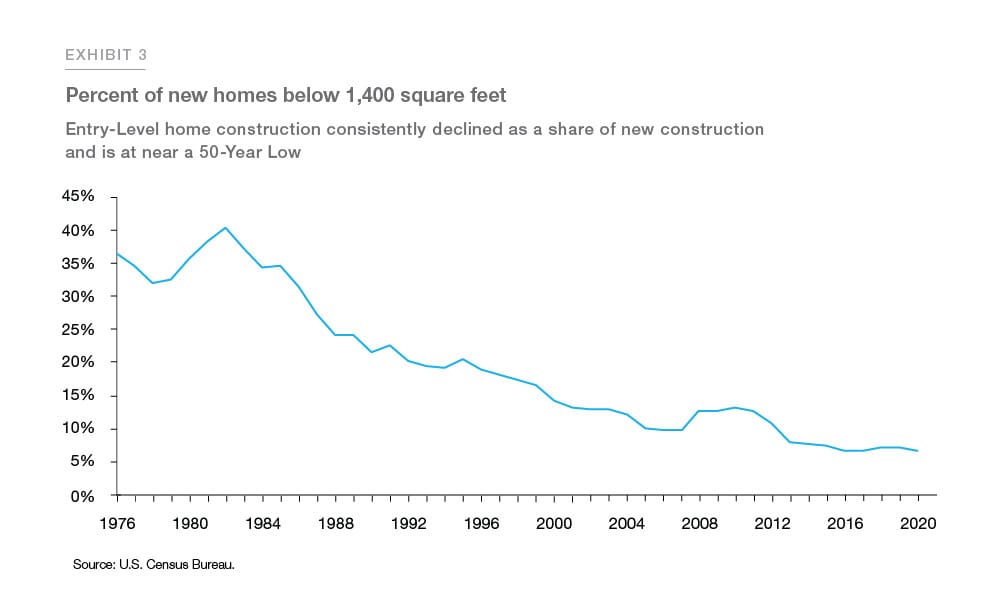

Furthermore, the housing market's challenges are not solely a matter of affordability but also reflect a profound lack of supply. Experts point out that the real estate market has been grappling with a housing supply crisis, exacerbated by a downturn in new home construction since the Great Recession. This imbalance between supply and demand suggests that simply boosting purchasing power without addressing the root causes of the housing shortage may not yield the desired outcomes.

Data from sources like Bloomberg and CNBC reveal the depth of the housing affordability crisis, with high mortgage rates and escalating home prices marking 2023 as a particularly challenging year for homebuyers, the toughest in over a decade. As of early March 2024, while the average interest rate for 30-year fixed-rate mortgages has seen a slight decrease, resting around 7%, there's a natural trend towards lower rates. However, introducing substantial financial incentives like the proposed tax credits, despite their good intentions, risks counteracting this organic progress. Injecting more money into the economy at this juncture could exacerbate inflation, potentially undermining the efforts to make housing more accessible and affordable for Americans.

Bloomberg

In light of these considerations, the efficacy of Biden's proposed tax breaks for first-time homebuyers and "starter home" sellers remains under scrutiny. While the initiative signals a notable effort to address housing affordability at the federal level, its impact may be limited by the intrinsic challenges of the current housing market, particularly the acute shortage of affordable homes and the complex dynamics influencing mortgage rates and property values. As the debate continues, the need for comprehensive solutions that tackle both demand and supply-side issues in the housing market becomes increasingly evident, underscoring the importance of a multifaceted approach to reform.

New York Cities Immigration Crisis

Migrants line up outside the Roosevelt Hotel in New York City

The interplay between immigration, particularly undocumented immigration, and the New York City housing market reveals a scenario of strained resources and escalating tensions. This influx contributes to the city's already acute housing shortage, with affordable units becoming increasingly scarce, thus disadvantageous to local residents in favor of undocumented immigrants. Beyond the direct impact on housing, there's a broader concern about the potential rise in crime rates associated with higher levels of undocumented immigration. An uptick in crime can erode community safety and well-being, ultimately depressing property values and deterring investment in affected neighborhoods.

New York City grapples with a dire shortage of affordable housing, a situation exacerbated by the continuous influx of immigrants. This demand surge strains the limited housing supply, often relegating immigrants to lower-quality housing due to affordability constraints, as noted by the NYU Furman Center. The scenario underscores a pressing dilemma: the city's affordable housing crisis is not only a concern for existing residents but is further compounded by new arrivals in search of accommodation.

Furthermore, the city's fiscal responsibilities are significantly burdened by the costs associated with providing for undocumented immigrants. According to the Federation for American Immigration Reform (FAIR), New York City is budgeting an astonishing $12 billion through the end of Fiscal Year 2025 to accommodate the needs of recent illegal migrants. This expenditure surpasses the annual budgets of the NYPD, FDNY, and Department of Sanitation combined. Such substantial financial commitments to support undocumented immigrants have led to cuts across city agencies, affecting services that benefit all New Yorkers. The repercussions of these financial commitments are felt directly by New York City residents, who must contend with the consequences of redirected funds—potentially leading to reduced services and quality of life, even as they shoulder the increasing tax burden required to fund these expansive efforts. The situation raises critical questions about the sustainability of such support, the fairness of imposing these costs on local taxpayers, and the long-term impact on the city's fiscal health and service provision to its residents.

The real estate sector feels the ripple effects of surging immigration, with JPMorgan highlighting intensified competition in the housing market. As immigration significantly contributes to population growth, the demand for housing—especially rentals—surges, exacerbating the affordability crisis and complicating the quest for affordable housing for both natives and immigrants. The Hill articulates how the housing and migrant crises intersect with predictable outcomes: increased demand from immigrants places upward pressure on rents and home prices, especially when affordable housing supply was already insufficient before the recent surge in immigration.

Concerns over potential increases in crime rates linked to higher levels of undocumented immigration add another layer of complexity. Perceptions of decreased safety can deter investment and residency in certain neighborhoods, impacting real estate values and market dynamics negatively. Crafting policies to confront these multifaceted issues involves bolstering affordable housing, safeguarding community safety, and fostering a balanced integration of immigrants, with considerations for their rights and needs.

For the collective benefit of all New Yorkers—established residents and newcomers alike—policymaking must strive for equitable housing resource distribution, community integration support, and the preservation of neighborhood safety and appeal. Addressing these issues is not just about tightening immigration policies but also about fostering a housing market that serves the needs of all New Yorkers. It requires a multi-pronged approach that includes enhancing the supply of affordable housing, ensuring that new arrivals do not disproportionately burden the existing infrastructure, and taking measures to maintain and improve public safety.

Pick Of The Week

For those of you who might not know, beyond the bustling world of real estate, I'm quite the sports fan! As we dive deeper into the season, I thought, why not sprinkle a little fun into our newsletter? Every week, I'll share my "Pick of the Week" for sports betting. While my expertise is firmly in real estate, I think this will be an enjoyable twist for our readers. But remember, it's all in good fun and purely for entertainment – always wager responsibly!

Growing up in Connecticut, I've been loving the run UConn basketball has been on —especially through the lens of a bettor. UConn hasn't just been winning; they've been covering the spread consistently, not just in this tournament but in last year's as well. The old saying "if it ain't broke, don't fix it" seems pretty fitting here. So, my bet of the week? I'm sticking with UConn, laying down -9.5 for the game and -5.5 for the first half. Let's keep the streak alive!

Pick of the week | Uconn -9.5 & Uconn -5.5 1H

Contact Me Today

Feel free to reach out to discuss more in-depth about your real estate goals, share your thoughts about my newsletter, or to share what you're experiencing in this market. I look forward to hearing from you!